April was a disastrous month for car makers, as sales were almost nil for most of them. Many car manufacturers have now rolled out schemes to attract buyers. Then, there are discounts and exchange offers too.

Should you buy a car by taking such financing schemes, discounts and exchange offers after the lockdown and are they worth it?

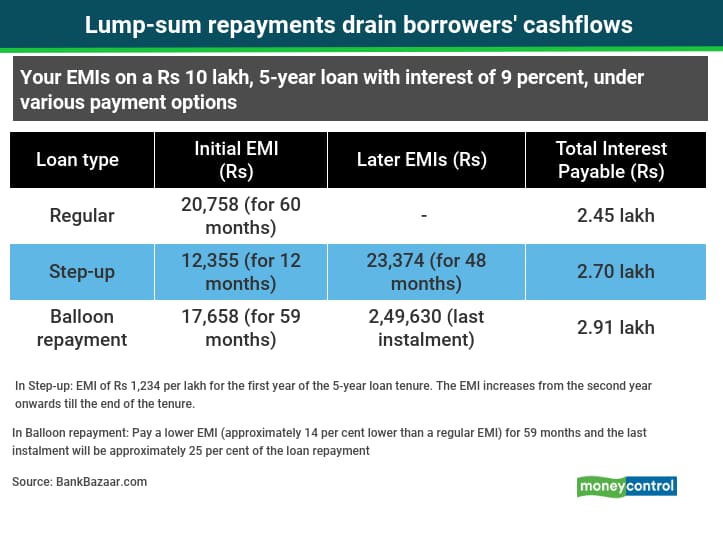

Naveen Kukreja – CEO and Co-founder, Paisabazaar.com says, “While opting for any of these finance schemes, the customers need to remember that the overall interest cost of these loans would be higher than the regular EMI loans, given that their lower repayment liability would lead to higher accrual of interest component.”

In this scheme offered by Renault, you have to start paying EMIs from the fourth month onwards. In the initial three months after purchasing the car, the interest will keep accumulating until you start your full EMIs. But if you don’t pay from fourth month onwards, your credit score will get impacted. Parijat Garg, a credit scoring consultant says, “Until you settle the outstanding loan, it will be difficult to access credit from formal financial institutions; even if you manage to get a loan, the rate of interest will be high.”

Step-Up EMI

The EMI increases from the second year onwards. Abhinav Kaul, Vice President-Strategic Partnerships, BankBazaar says, “In today’s COVID-19 crisis, the step-up option could be a good bet as it lets you start your EMIs with small amounts and then go up over the next one or two years, as your financial stability improves.” However, you may end up taking a higher EMI commitment based on future incomes, which may be uncertain due to job losses and wage cuts.

Balloon repayment

A five-year car loan will involve the customer paying 14 per cent lower amounts than regular EMIs for 59 months; last instalment will be approximately 25 per cent of the loan. This scheme is suitable for borrowers who want to keep their monthly expenses low and are certain of their ability to repay the last instalment. Gaurav Gupta, Co-founder and CEO of MyLoanCare.in says, “The caveat in the balloon repayment scheme is that these loans turn out to be costlier as you keep paying interest on a significant loan amount outstanding till the end of the tenure.” The last installment more than makes up for the low EMIs you would have paid throughout.

Kaul says, “Compared to the regular car loan scheme, the step-up and balloon repayment plans are more expensive.”

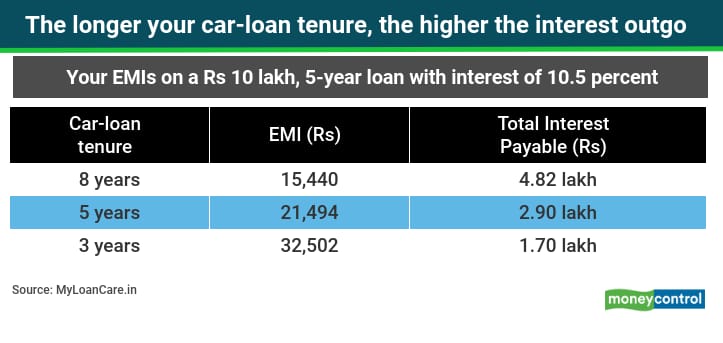

Should you opt for longer-tenure loans?

Car makers offer loans of eight-year tenures, by tying up with banks and financial institutions. Sapna Tiwari, Co-founder and COO, Rupeewiz Investment Advisors says, “You should prefer short tenure for car loans if you can afford the EMIs. While a shorter tenure leads to a higher EMI amount, it also results in lower interest costs.”

The table below illustrates the savings made by taking a shorter-tenure car loan.

Moneycontrol’s take

It is advisable to avoid finance schemes such as step-up and balloon repayments, as well as long-tenure loans, as the total interest outgo in these schemes is higher than what a regular car loan entails.

You should also check the processing fee, pre-payment and other charges associated with a car loan. If you have a good credit score, you can negotiate for better rates and a waiver of charges. This will reduce the effective cost of owning a car. Finally, you must also analyse if your job and income are stable enough to service a car loan.

source: moneycontrol