What is the market going to do today?

Investors can look to data releases to explain short term fluctuations and try to investigate longer-term macro trends to make their forecasts.

However, the market is (mostly) humans making decisions based not only on what they think will happen after extrapolating the data, but also on how they feel things will work out. Call it sentiment, call it animal spirits, but also call it very hard to measure.

Addressing this issue is a new statistics paper published on the European Central Bank’s website, and carrying the rather mundane title of “Quantifying the effects of online bullishness on international financial markets.”

Don’t let the name put you off though; the analysis shows that if you want an idea of where market sentiment is, Twitter is the place to go.

The authors of the paper, use what they describe as “a simple, direct and unambiguous indicator of online investor sentiment,” based on Twitter updates and Google searches.

They produce two main findings:

- First, changes in Twitter bullishness predict changes in Google bullishness, indicating that Twitter information precedes Google queries.

- Second, Twitter and Google bullishness are positively correlated to investor sentiment and lead established investor sentiment surveys.

More simply, if we want to know where investor sentiment is, Twitter beats Google and both of them beat established sentiment surveys. More importantly, since bullishness on Twitter and Google is positively correlated to investor sentiment as shown in share price movements, Twitter is both first and right.

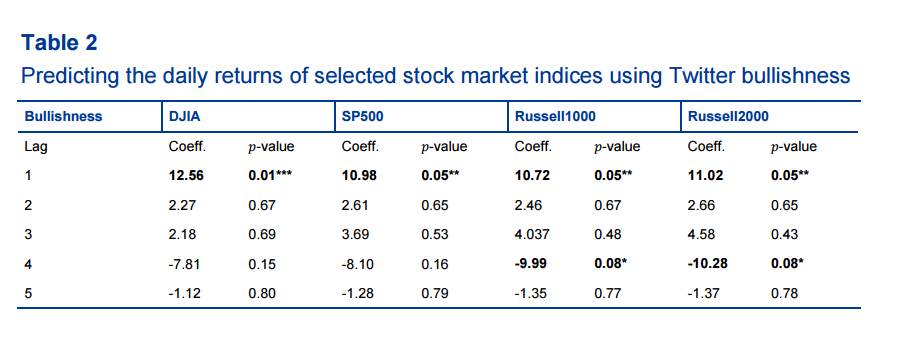

For the more quantitatively-minded, the authors produce a table of the results of their Twitter analysis versus realized stock market movements.

They also warn that the Twitter bullishness indicator only works in markets where Twitter has large penetration. For example the Twitter bullishness indicator has only a modest correlation with Chinese stocks as the social media platform is simply not available in China.

Further, they say, while promising further work on this, that their study offers no information with regard to causality.

Investors are unlikely to be worried about why this works, just so long as it does work – and it seems from this paper, that when it comes to measuring sentiment, Twitter cannot be beaten.

[SOURCE- bloomberg.com”]