Abstract

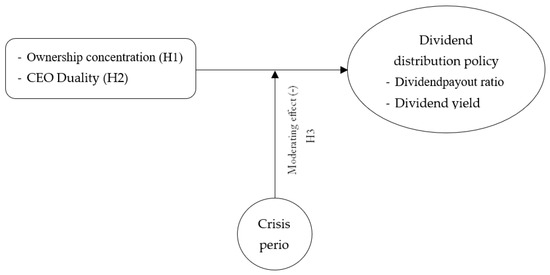

Despite developments of recent theoretical and numerous empirical studies on the policies effectively adopted by companies, the dividend distribution policy (DDP) remains largely unexplained. In this regard, the main purpose of the current study is to empirically examine the effects of both CEO duality and ownership concentration on DDP during a crisis period. Furthermore, we test, using an interaction variable, the moderating effect of the crisis period on the association between both the degree of CEO duality and the ownership concentration on the DDP by analyzing panel data on selected listed firms in an emerging economy, namely, Tunisia. Based on a sample made up of 576 firm-year observations over the period 1996–2019, the findings of this research indicate that the crisis period plays an important role in mitigating the positive effect of both CEO duality and ownership concentration on DDP. The findings confirm furthermore that the crisis period on the one hand and both CEO duality and ownership concentration on the other represent two competing forces influencing DDP. Our results also support the agency theory on which DDP depends, among other things, family ownership, board and company size, and ROE. View Full-Text