Loyalty card reward programmes have been singled out by PwC economists as one of the top five drivers of blockchain technology over the next decade. They expect blockchain to breathe new life into traditional, card-based loyalty and reward programmes, generating some US $54 billion for the global economy by 2030.

It’s quite a moment for the collection of humble plastic cards that have been sitting gathering dust in peoples’ wallets for years. As the report Time for Trust: The trillion dollar reason to rethink blockchain explains, blockchain has a crucial role to play in our increasingly digital global economy. Our economists have looked at how the technology is currently being used across every industry and they argue that the technology is on track to deliver a $1.76 trillion boost to the global economy by 2030 – with the majority of businesses using blockchain technology from 2025.

With loyalty programmes, blockchain technology has the ability to boost engagement and generate value by making them far more user-friendly for today’s generation of smartphone users. Loyalty and reward programmes are well overdue a revamp; a study last year revealed that the average consumer is involved in 14 loyalty programmes, but only has the capacity to engage in seven. The same study revealed that only 22% are very satisfied with levels of personalisation on offer.

Reward cards were created in the 1980s when we still bought things with cash. The idea is still sound – people love collecting rewards – but redemption rates are low. Consumers just aren’t chomping at the bit to use them as much as they could be. The younger generation doesn’t want a wallet full of plastic cards. They are more likely to be carrying around nothing more than a smartphone as a means of payment. They want to redeem, share and swap their points, whether air miles or supermarket rewards, on their smartphone.

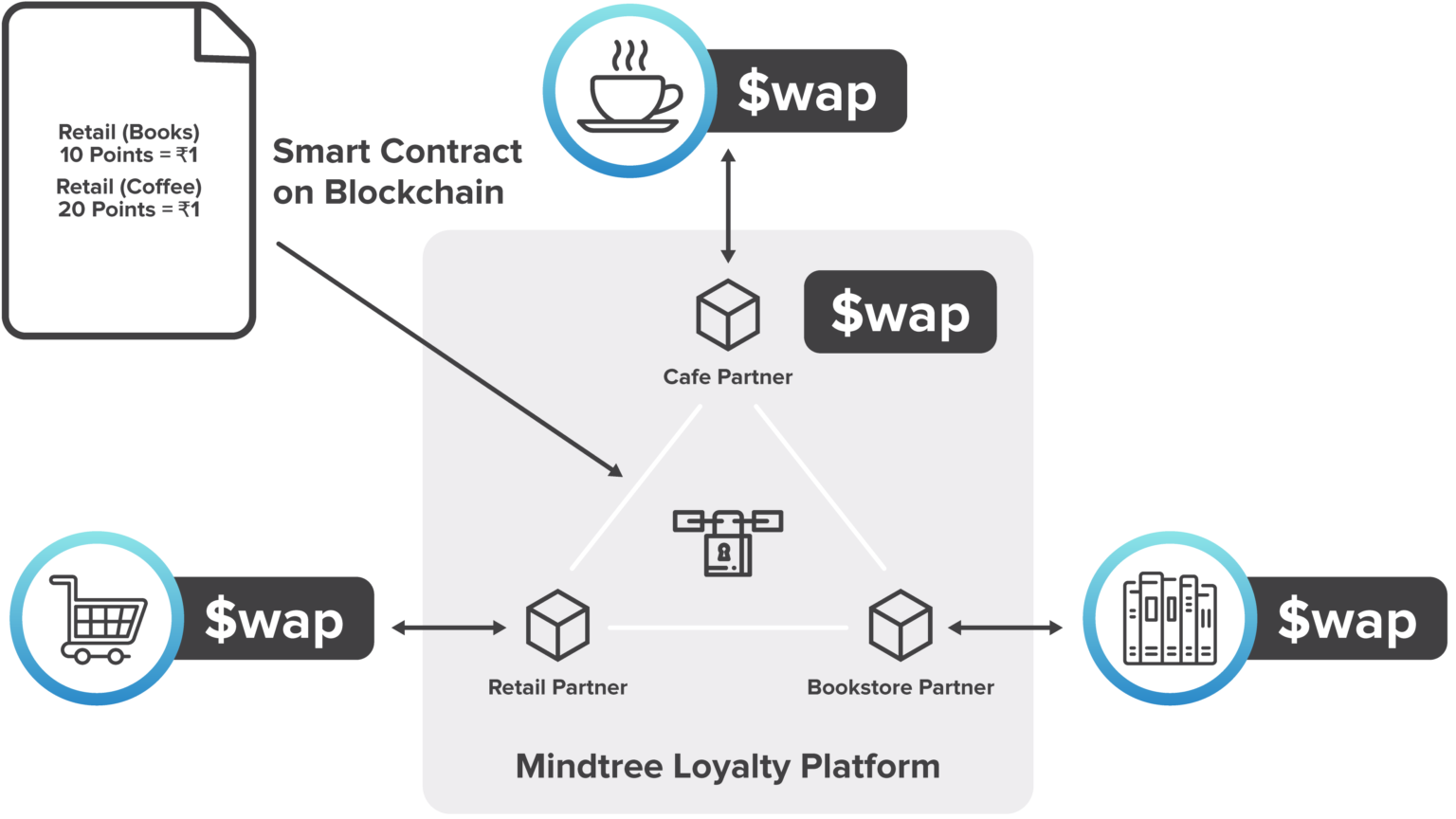

That’s not unreasonable, but integrating all that information is fraught with complexities. This is where blockchain can help, allowing consumers to store, check, consolidate and spend points online. It can also be used in a similar way for gift cards and vouchers. With digital payments now the norm, consolidation of these schemes is not just possible, but inevitable.

To find out more about how blockchain is unlocking value for companies right now, read our new report Time for Trust. Learn which industries and countries are set to reap the biggest rewards from the technology, explore our research and read the insights from our global industry experts.

And please, to find out more about how blockchain can create value for your organisation, get in touch.

[“source=pwc.blogs”]