You’ve got your emergency fund set up — three to six months of living expenses set aside for unexpected events — and you’re finally feeling a sense of financial security. But what, exactly, constitutes a financial emergency?

We asked financial advisor Laura Scharr-Bykowsky for tips on when to tap your emergency fund and other advice on saving up for a rainy day.

When Should People Tap Their Emergency Funds?

Emergency funds provide peace of mind when there’s an unusual or catastrophic event in your life. Loss of income due to unemployment or disability is the primary intended use. Your emergency fund can also provide much-needed money if you face a major medical event.

Your fund should be able to cover out-of-pocket deductibles for your health, property and casualty insurance and at least six months of income to cover your expenses during a job search. Keep the money in a cash account insured by the Federal Deposit Insurance Corp.

Does it Ever Make Sense to Use It for a Non-emergency?

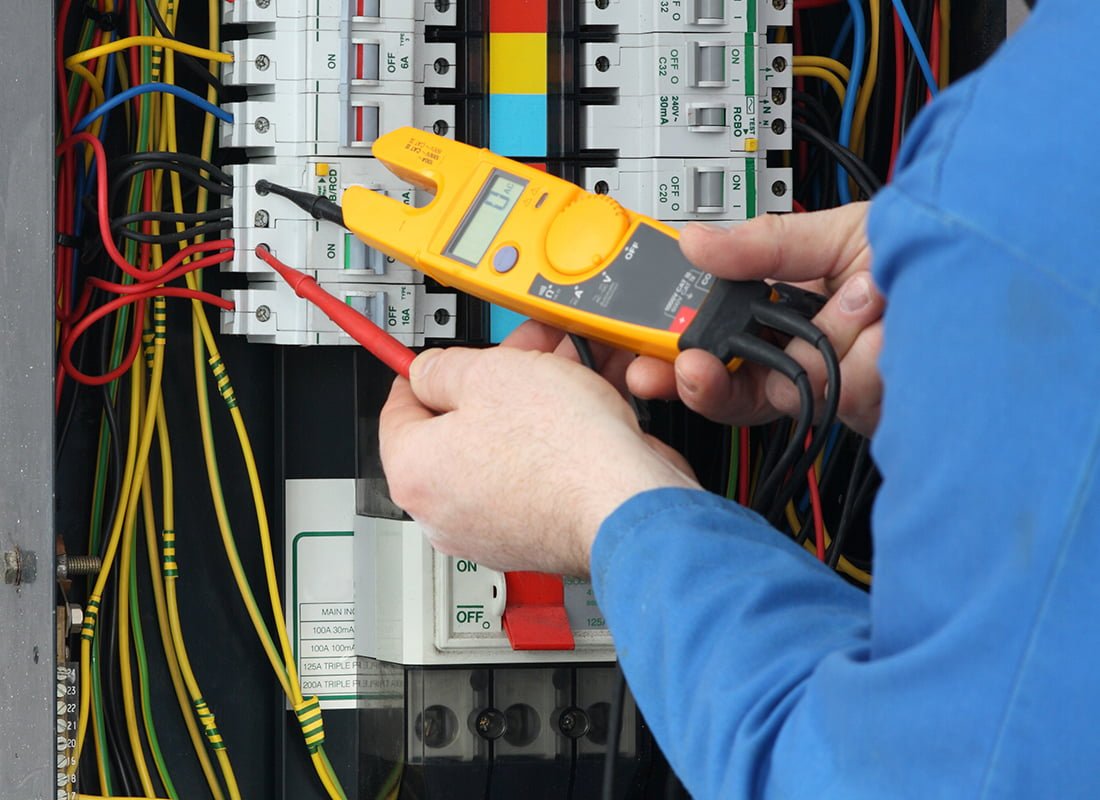

Some people may decide to tap this account if they have a large, unexpected maintenance or repair bill such as a new roof or heating and air conditioning unit. Others may raid their account to buy a new car. If you deplete your account in this way, try to build it back up as soon as possible, because you’ll be vulnerable if you have a true emergency. I would recommend this only if you have a stable job and good insurance.

Any Other Savings Tips?

Set up separate savings accounts for different goals and include a line item in your monthly budget to save for these less frequent expenses — for example, one savings account for home repair, one for car replacement and another for at least six months of living expenses.

This method can prevent you from raiding your emergency fund. Setting up separate savings accounts is easy and helps us stay honest with our spending.

[“Source-smallbiztrends”]