Being good at finances is all about education. Whether you’re new to staying on top of your finances or need some fresh inspiration to grow your wealth, you can turn to finance and investment blogs to educate you on all things on finance. However, there are so many facets to finance that one person, or one blog doesn’t cover them …

Make Your Money A Daily Routine

Starting a new routine in any area of life can be challenging. Be it changes to your finances, exercise habits, health or any other type of new routine, one of the best ways that you can increase your chances of success is to make it part of your existing daily routine. Making small changes to something you’re already doing drastically …

10 Best Personal Finance Blogs to Increase Your Money Skills

Understanding and managing your finances can be challenging. But never fear — personal finance bloggers are here to save the day! At personal finance blogs, you’ll find the tools you need to get out of debt, save up for your first home, and more. These experts offer free tips, tricks, and explanations for complex financial concepts. Here are 10 of the best …

Family finance: How salaried Singhs can achieve their money goals easily

Raman Singh and Amrita Kaur are both employed and bring in a combined monthly salary of Rs 1.5 lakh. They live in their own house worth Rs 1 crore, in Delhi, with their two children, aged eight and four. They have no liabilities, and their portfolio comprises equity in the form of mutual fundsworth Rs 82.2 lakh, debt worth Rs 90 …

How to save money on travel (including bucket list destinations)

Whether it’s written down in the back of your agenda, in a note on your phone or filed away in a mental cabinet to be called on by daydreams when work and life get too hectic, we all have a bucket list of places we’d love to go. Unfortunately for many of us, that’s exactly where these destinations stay — on …

Family finance: Why Pune-based Agarwals are on the right track to achieving their money goals

Sahil Agarwal, an IT consultant, stays with his homemaker wife and one-year-old child, in Pune. He stays on rent, even though he has his own house, which provides a rental income of Rs 12,000 a month. Combined with Agarwal’s monthly salary of Rs 91,000, his total income comes to Rs 1.03 lakh. The household expenses amount to Rs 57,000, insurance premium accounts …

Ex-Googler Turns Mom’s Money Into a Billion Dollars

HIGHLIGHTS With less than $1 million in capital he moved from California to Shenzhen Anker is now valued at about $1.1 billion Company is embedded with the supply chain in Shenzhen After Steven Yang left his coveted job at Google, he asked his mother whether he should take venture-capital money to fund his business idea. If his online consumer-electronics enterprise was …

What is AAA Travel and Can It Save You Money On Travel?

Before you could research and book your travel in an instant on the Internet, you needed AAA Travel. The information superhighway has made DIY travel planning extremely easy, but travel agencies including AAA Travel still exist. If you’ve grown up in the Internet age, you’re probably wondering what is AAA Travel? If you or you’re family booked a flight or planned …

How Technology Can Save Your Small Business Big Money

If you own a small business, you know how important it is to keep costs down and profits up. In fact, experts say that over 80% of small businesses that fail do so because they suffer from problems with their cash flow. No matter how great your business idea is, if you can’t fund it, it won’t succeed in the …

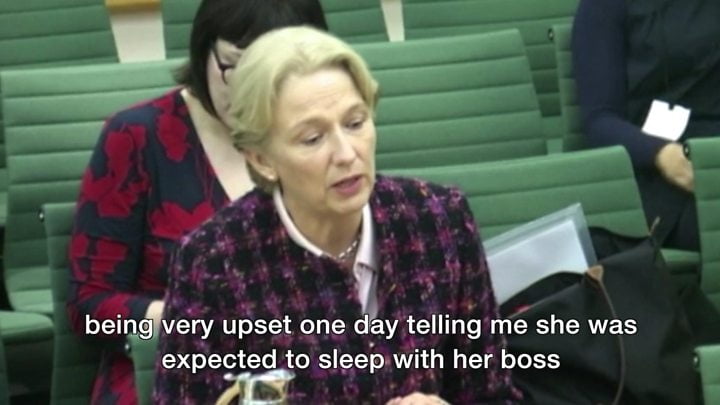

Sexism was pervasive in finance, says Virgin Money boss

Virgin Money boss Jayne-Anne Gadhia has told MPs that sexism was “pervasive” in the “very male culture” of finance. Ms Gadhia spoke of one example from her time at Royal Bank of Scotland when a senior woman was very upset because she was “expected to sleep with her boss”. She was speaking to MPs as part of their inquiry into …